Insurance Your Mobile Phone -Very Easy And Fast process. In today's world of technology, how to insure your mobile phone has become an increasingly important question. After all, the smartphone is extremely portable. What happens when it gets dropped? A Consumer Reports survey revealed that smartphone users are likely to experience mishaps. For example, one respondent accidentally drowned their phone in the washing machine. Another accidentally ran over the phone with a car, and a third even used the smartphone as a chew toy. Fortunately, extended warranty plans can protect your phone against these kinds of mishaps. But be aware of the limitations of these plans and be sure to read the fine print of the policy before you sign up for one.

|

| Insurance your mobile |

SquareTrade

SquareTrade insurance is a great option for protecting your cell phone in case of an accident. The policy covers all kinds of damages and issues, including cracked screens, liquid damage, speak/audio problems, and battery and charging port failures. Most of the cases can be taken care of the same day, but some can take up to five days. SquareTrade offers a variety of coverage plans to suit your needs. This article will outline some of the benefits of SquareTrade mobile phone insurance.

Depending on the specific coverage plan you purchase, you may have to pay as much as $198 before you break even. However, if you buy a new phone, the warranty will cover the cost of the new phone. However, keep in mind that you are only covered for the original purchase price. You may want to get a different insurance plan if you're buying a phone for a special occasion. For example, if you bought a phone on eBay, you may only want to purchase it for a special occasion.

In addition to accidental damage coverage, SquareTrade offers several other features that make it a great choice for mobile phone users. The company covers phones and other devices for a lower price than the carriers. However, they do not guarantee that you'll get the same model when you purchase your SquareTrade plan. It's possible that you may end up with a different color, type, or even a refurbished phone instead.

|

| Square trades |

AT&T

Whether you've got an iPhone, Android, or Blackberry, you can protect it with AT&T insurance. The company offers three plans to suit the needs of all users, with the basic plan limiting its benefits to physical damage. Protection 360 covers a variety of problems, from accidental damage to theft and loss. You can pay monthly or yearly to continue coverage, which allows you to choose the best plan to meet your needs.

The basic Mobile Insurance plan from AT&T covers loss, damage, and malfunction, but does not include a lot of the additional features available with Protect Advantage. Streaming support and unlimited battery replacements aren't necessary for most people, but it will still cost you less than Protect Advantage for coverage for up to four devices. This plan also covers laptops, tablets, and other devices. It's also cheaper than Protect Advantage if you plan to keep multiple devices.

With the same plan, if your phone has a technical malfunction, you can file a claim at the AT&T warranty center. You may get a new phone within 24 hours if your old one is covered under the manufacturer's warranty. You may also be able to negotiate smaller payments with customer support. AT&T's standard mobile insurance plan costs $9 USD per month and covers only the replacement phone. You can also purchase the Mobile Protection Pack that provides tech support, photo storage, and all services for up to three devices.

|

| AT&T |

AKKO

AKKO insurance mobile phone coverage offers affordable premiums for a range of damage. For instance, AKKO offers theft protection, while SquareTrade's coverage does not. Unlike SquareTrade, AKKO does not limit the number of claims per year, although the maximum claim amount is $2,000 for a single device. Additionally, AKKO insurance mobile phone coverage also extends to 25 other electrical items.

Many cell phone insurance plans restrict the number of claims a single account can make during a calendar year. Families need access to more claims each year, and AKKO does not impose this restriction. You can submit claims throughout the year, which is great news for families with multiple phones. The company is also very easy to use. The company provides an easy-to-navigate app and desktop system. Whether you're on the go or stuck at home, AKKO's customer service is always accessible.

AKKO insurance mobile phone coverage includes unlimited claims, theft and accidental damage coverage, and coverage for up to 25 valuable items. With just a few minutes to sign up, you can enjoy a variety of benefits. And you won't have to worry about the cost of repairs or replacements if you've recently upgraded your phone. AKKO also has flexible plans with deductibles ranging from $29 to $99 per claim.

Home contents insurance

Most contents insurance policies include cover for mobile phones when kept in the home. Claims for lost or stolen phones are usually covered for fire, storm damage, and theft. Fraudulent calls, however, are not covered. The standard policy excess will apply to claims for mobile phones, but there are special policies for such items. You should check the small print carefully before signing up for home contents insurance for mobile phones. The following information may help you choose the right policy for your needs.

One of the most common types of home contents insurance is the standard one. While this provides basic cover, it is unlikely to offer full protection for mobiles. This is because 99% of home contents policies have single item limits and may not cover expensive gadgets. As such, it is advisable to buy a separate insurance policy for your mobiles. However, if you're concerned about your phone being stolen or damaged, you may want to consider a separate insurance policy for it.

Another type of home contents insurance for mobile phones covers smartphone theft and damage caused by insured risks. In many cases, home contents insurance for mobile phone will replace your device with the original value if it is stolen or damaged. In addition, some policies cover several smartphones in a household. Home contents insurance also covers burglary and theft. It's worth noting that home contents insurance for mobile phones includes exclusions. If you have a large number of smartphones and a high-end smartphone, it is best to get separate coverage to ensure you're protected in case of a break-in.

Credit card

If you have a credit card, you probably already have coverage for your cell phone. However, some credit card companies have adapted these benefits to the changing consumer habits. Here are a few things you should keep in mind when buying a new cell phone. First, most credit cards require you to file a claim within a certain time period. This is because credit card companies need to receive your information within a set amount of time. It is therefore best to file your claim as soon as possible.

Second, cell phone insurance is a great way to protect yourself against the high cost of a flagship smartphone. Even if you never need to use your phone, it is still important to have some form of insurance, especially if it is stolen or damaged. If you're concerned about losing your phone, a cell phone insurance policy will reimburse you up to $600 if you're covered for stolen or damaged devices. The insurance also comes with a $100 deductible. While this type of cell phone insurance isn't for everyone, it's always a good idea to have it.

However, the insurance policy of each credit card is different, and may vary between companies or even individual cards. Before signing up for a cell phone insurance plan, read the fine print. Be sure to understand the exclusions and limitations of the policy. Some protection plans may only cover cosmetic damage. You should research the terms and conditions of any coverage before signing up. So what do you need to consider? It is important to make the right choice and compare various policies before choosing the best cell phone insurance for you.

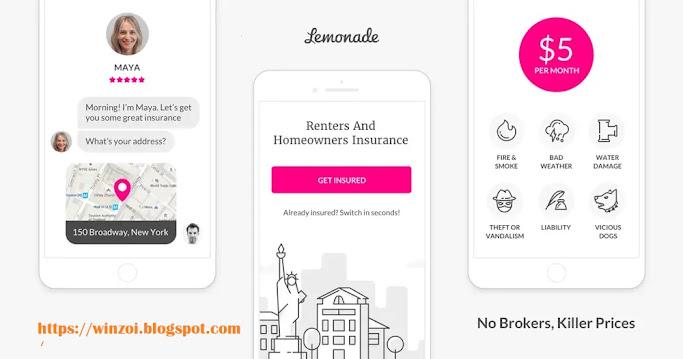

Renters insurance

When you rent an apartment, you probably don't think about renting renters insurance for your mobile phone. Despite the popularity of cellphones, most renters insurance plans do not cover the cost of replacing a broken cell phone. Damage caused by water or by impact from a hammer is not covered, and the insurance will not reimburse you for the cost. However, there are some special circumstances in which your cell phone might be covered.

|

For instance, you might be able to find a policy with an insurance company that offers mobile phone insurance for about $12 a month. The cost of renters insurance depends on the amount of valuables you have and the type of home you rent. GEICO's mobile phone insurance is affordable and offers up to $1 million in coverage. In addition, some landlords require their tenants to carry renters insurance. As a result, you must consider your personal needs before deciding which type of insurance is best for you.

In addition, you may want to make sure you're adequately covered for any electronic devices that are inside your apartment. You may need to increase the coverage limits on your renters insurance policy if you own valuable possessions. You can also choose between replacement cost coverage and actual cash value coverage. Ultimately, renters insurance for mobile phones is about protection against the financial stress that can arise when an unexpected tragedy occurs. If you're wondering if your policy will cover your mobile device, make sure you check your policy terms and conditions carefully.